What Is an Akcinė Bendrovė?

An Akcinė Bendrovė (AB) is a legal corporate entity whose capital is divided into shares owned by shareholders, known as akcininkai. In this structure, each shareholder’s ownership stake corresponds to the number or value of shares held, and shareholders may earn dividends based on company profits. This form of company is equivalent to a joint‑stock company or public corporation in many other countries, and it’s one of the most powerful business forms for larger‑scale operations. VLE

Unlike small, private businesses, an Akcinė Bendrovė is structured to support significant capital raising and shareholder participation. In fact, many of Lithuania’s most recognized companies — such as Lietuvos Draudimas and ORLEN Lietuva — operate as ABs, trading shares and attracting institutional and public investment. LEI Report+1

Key Features of an Akcinė Bendrovė

The core features that distinguish an Akcinė Bendrovė include:

- Share Capital Structure: The company’s capital is divided into shares, which may be publicly traded or privately held. Shareholders benefit from limited liability — they are only responsible up to the value of their shares. VLE

- Public Participation: ABs can issue shares that are available for public trading, enabling broader capital participation beyond founders and initial investors. Floors R Us Killeen

- Governance Structure: An Akcinė Bendrovė typically has a board of directors, a CEO or management team, and required corporate governance mechanisms that ensure strategic oversight and accountability. Floors R Us Killeen

This structure helps the company attract investment, scale operations, and compete on broader economic stages — but it also means stricter regulatory compliance and transparency obligations compared to smaller company types. Incfine

How an Akcinė Bendrovė Differs From Other Company Types

In Lithuania, there are several corporate forms — but the two most similar are Akcinė Bendrovė (AB) and Uždaroji Akcinė Bendrovė (UAB):

- AB (Akcinė Bendrovė): Designed for larger enterprises that may seek public investment or plan to trade shares on financial markets. There is usually a higher minimum capital requirement compared with UABs, and governance structures are more formal. VLE

- UAB (Uždaroji Akcinė Bendrovė): More comparable to a private limited company, UABs cannot publicly trade shares, and share transfers are more restricted. UABs are popular for small and medium‑sized businesses due to simpler setup and lower capital requirements. Incfine

Essentially, the choice between AB and UAB depends on scale, funding needs, and long‑term strategy — whether a company aims for public share distribution or maintains a more private ownership structure. Trys Karaliai

Advantages of an Akcinė Bendrovė

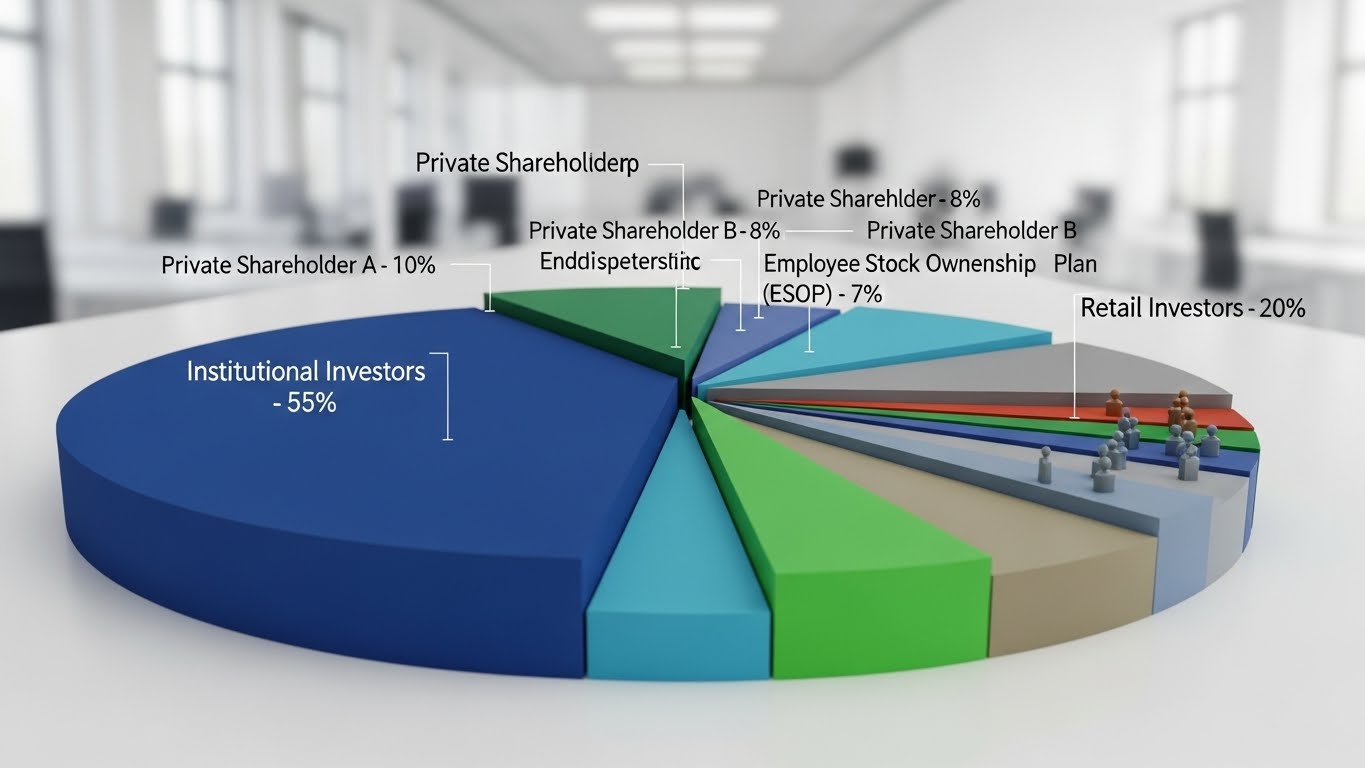

One of the biggest advantages of forming an Akcinė Bendrovė is its access to capital markets. By issuing shares, an AB can raise funds not just from founders but from institutional investors and the public, allowing expansion into new markets or diversification of operations.

Another advantage is the limited liability protection that shields individual shareholders from losing more than their invested capital if the company faces financial trouble. This encourages investment and makes the structure attractive for larger projects and corporate growth. VLE

In addition, ABs often have enhanced corporate governance practices — such as boards and audits — which can improve transparency and investor confidence, particularly in sectors where trust and stability matter. Floors R Us Killeen

Examples of Akcinės Bendrovės in Lithuania

Across Lithuania, many notable companies use the Akcinė Bendrovė structure. These include:

- Akcinė Bendrovė ORLEN Lietuva — a major energy and oil refining company with established public operations and shareholder functions. LEI Report

- Akcinė Bendrovė Lietuvos draudimas — one of the leading insurance companies in the region, operating under the AB legal framework. Lursoft

- Other long‑standing ABs such as Akcinė bendrovė Kauno grūdai and Akcinė bendrovė Lietuvos geležinkeliai demonstrate the diversity of industries — from agriculture to transportation — that benefit from this corporate form. Lursoft+1

These companies show how Akcinė Bendrovė functions both in private markets and public economic spaces, fueling investment and employment across sectors. Lursoft

Legal and Operational Considerations

Forming an Akcinė Bendrovė involves a series of legal and administrative steps. Founders must define the company’s share capital, governance bodies, and articles of association, and they must register with the Lithuanian Register of Legal Entities.

ABs also typically face more rigorous reporting and auditing requirements than smaller firms. This is part of ensuring fair market practices, investor protection, and compliance with Lithuania’s regulatory framework. Floors R Us Killeen

Because ABs can trade shares publicly, they are subject to standards that protect shareholder rights and ensure financial transparency, which is vital for investor confidence and capital mobilization. VLE

Conclusion: Why Akcinė Bendrovė Matters

An Akcinė Bendrovė is more than just a company type — it’s a cornerstone of Lithuania’s corporate ecosystem. For businesses that aim to grow, attract diverse capital sources, and operate at a national or international level, the AB structure offers vital tools for expansion and governance.

Whether you’re a business owner considering your next step, an investor analyzing opportunities in Lithuania, or a student learning about European corporate law, understanding the nuances of Akcinė Bendrovė provides key insights into how modern enterprises are built, funded, and regulated.

FAQ Section for SEO Snippets

Q1: What is an Akcinė Bendrovė (AB)?

A: An Akcinė Bendrovė, abbreviated as AB, is a Lithuanian joint-stock company whose capital is divided into shares owned by shareholders. It is equivalent to a public corporation in other countries.

Q2: How is an AB different from a UAB?

A: While an AB can issue publicly traded shares and usually has higher capital requirements, a UAB (Uždaroji Akcinė Bendrovė) is a private limited company with restricted share transfers and simpler governance.

Q3: Can an AB trade shares publicly?

A: Yes. One of the defining features of an Akcinė Bendrovė is its ability to issue shares for public trading, attracting institutional and retail investors.

Q4: What are the advantages of forming an AB?

A: ABs offer access to capital markets, limited liability for shareholders, and stronger corporate governance, making them suitable for large-scale operations.

Q5: Are ABs regulated in Lithuania?

A: Yes. ABs must comply with Lithuanian corporate law, including registration, reporting, and auditing requirements, to ensure transparency and shareholder protection.

Lithuanian-English Glossary for Business Terms

| Lithuanian Term | English Translation | Explanation |

| Akcinė Bendrovė (AB) | Joint-Stock Company / Public Company | Company structure with shares and limited liability. |

| Uždaroji Akcinė Bendrovė (UAB) | Private Limited Company | Private company with restricted share transfer. |

| Akcininkas | Shareholder | An individual or entity owning shares in a company. |

| Valdyba | Board of Directors | Governing body responsible for strategic decisions. |

| Stebėtojų taryba | Supervisory Council | Oversees company management in large ABs. |

| Dividendai | Dividends | Profits distributed to shareholders. |

| Įstatinis kapitalas | Share Capital | Total capital divided into shares. |

| Įmonių registras | Register of Legal Entities | Official registry for Lithuanian companies. |

Comparison Chart: AB vs UAB vs MB (Individual Enterprise)

| Feature | AB (Akcinė Bendrovė) | UAB (Uždaroji AB) | MB (Mažoji Bendrija) / Sole Proprietorship |

| Legal Form | Joint-stock company / Public | Private limited company | Partnership / Sole Proprietorship |

| Share Capital | High minimum requirement | Lower minimum requirement | No formal share capital |

| Share Transfer | Publicly tradable | Restricted | N/A – owner controls |

| Ownership | Multiple shareholders | Few shareholders allowed | Single owner or partners |

| Liability | Limited to share value | Limited to share value | Unlimited (personal liability) |

| Governance | Board + CEO + supervisory council | Board optional, simpler | Owner-managed |

| Best For | Large companies, public trading | SMEs, private ownership | Small business, freelancers, startups |

| Regulatory Requirements | Strict reporting & auditing | Moderate reporting | Minimal reporting |